Buying a used car can be an exciting way to save money, but it’s challenging. One of the most important things to check before finalizing your purchase is whether the car has a lien. A lien on a car can cause severe legal and financial issues for unsuspecting buyers. Understanding what it means for a car to have a lien and why it matters is crucial for protecting yourself and your investment.

Let’s break down what a lien is, why it’s essential to check for one, and how tools like Vehicles Report can help you avoid costly mistakes.

What Does It Mean When a Car Has a Lien?

A lien is a legal claim placed on a car by the lender or mechanic as security for the debt. If the car owner doesn’t pay the debt, the lienholder can take ownership or sell the car to recover the money.

Commonly, the lien usually occurs when someone finances a car purchase with a loan. The lender can claim the vehicle until the loan is fully paid off.

Liens aren’t limited to lenders. A mechanic’s lien might arise if the car owner fails to pay for repairs. Regardless of the type, a lien makes transferring full ownership to a new buyer challenging.

Types of Liens

Not all liens are the same. Here are the most common types:

1. Financing Liens

These occur when a car is purchased through a loan. The lender retains a legal interest in the car until the loan is paid off.

2. Mechanic’s Liens

A mechanic’s lien may be placed on a car if the owner fails to pay for repair services. This can prevent the sale of the vehicle until the debt is resolved.

3. Tax Liens

Government agencies can place a lien on a car if the owner owes unpaid taxes.

Understanding these liens helps you identify potential red flags when buying a used car.

Why You Should Care About a Lien on a Car

Buying a car with a lien can lead to significant headaches, even if you weren’t aware of the lien beforehand. Here’s why:

1. The Car Could Be Repossessed

If the lienholder isn’t paid, they can repossess the car—even if you’re the new owner. This leaves you without money and a car.

2. You Could Face Legal Trouble

Liens don’t disappear when ownership transfers. If a lien exists, you could end up tangled in legal disputes.

3. You Might Pay Twice

Sometimes, you may need to pay the lien to keep the car, meaning you pay twice for the exact vehicle.

These risks make it essential to confirm a car’s lien status before purchasing.

How to Check if a Car Has a Lien

Checking for a lien on a car isn’t difficult, but it does require careful attention to detail. Here’s how to do it:

Step 1: Ask the Seller for Proof of Clear Title

Request to see the car’s title. A clean title means no active liens.

Step 2: Contact the DMV

Most DMVs can provide lien information based on the vehicle’s VIN (Vehicle Identification Number).

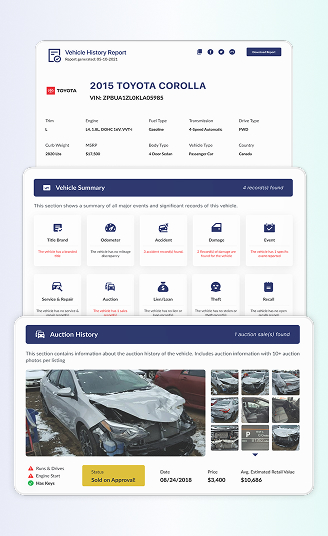

Step 3: Use a Vehicle History Report

The easiest and most reliable way to uncover lien information is by using a vehicle history report. Services like Vehicles Report provide detailed data about the car, including its lien status, accident history, and title details.

How Vehicles Report Can Help You Avoid Buying a Car With a Lien

When buying a used car, information is your best defense against potential problems. Vehicles Report makes the process simple and stress-free by providing comprehensive vehicle history reports.

With Vehicles Report, you get:

- Lien Information: Verify whether the car has any active liens.

- Title History: Check for clean or salvage titles.

- Accident and Maintenance Records: See if the car has been in major accidents or has outstanding recalls.

By entering the VIN, you’ll instantly access critical details to make an informed decision. This ensures you won’t accidentally purchase a car with hidden legal or financial issues.