Buying a secondhand car using the bank’s lien service can be straightforward; however, it could become complicated if you fail to fulfill your responsibilities toward the lien. The lien can affect your car ownership, financial condition, and the selling or buying process of the car, both new and used. Many buyers and sellers don’t understand what a lien is, its responsibilities, and why it matters–until it’s too late to understand.

With a clear understanding of this legal claim on a vehicle, you can avoid inheriting unexpected financial burdens or encountering roadblocks during the transfer of ownership. The good news is there’s an easy way to protect yourself and ensure a smooth transaction: a simple vehicle history report.

In this article, we’ll dive into what a lien on a car is, why it’s important, and how a VIN check with Vehicles Report can help you verify the lien status before you make your next purchase.

What is a Lien on a Car?

At its core, a lien on a car is a legal claim against the vehicle, typically placed by a lender or another entity to secure a debt. When you finance a car through a loan or lease, the lender places a lien on the vehicle as collateral. Even though you’re driving the car, the lender technically owns it until you pay the debt in full. If you fail to make your payments, the lender has the right to take back the car through repossession to recover their losses.

Simply put, a lien protects the lender’s investment by ensuring they can seize the vehicle if you don’t fulfill your financial obligation. This is particularly common when financing a new or used car through a bank or credit union.

Types of Car Liens

Liens come in various forms, and understanding the type of lien attached to a vehicle is crucial for buyers and sellers. Here are the most common types of liens you should be aware of:

Lender Liens

These are the most common when a bank, credit union, or finance company provides a loan to purchase a car. The lien is attached until the loan is paid off in full.

Mechanic’s Liens

A mechanic’s lien is placed on a vehicle if the owner fails to pay for repairs or maintenance. While less common, these liens can complicate the car’s ownership if unpaid.

Tax Liens

Sometimes, the government can place a lien on a vehicle if the owner fails to pay taxes, such as unpaid registration fees or back taxes. This lien can prevent the owner from selling or transferring the vehicle until the debt is cleared.

Storage Liens

If a vehicle is abandoned in a storage facility or impound lot, the facility may place a lien on the car to cover storage fees. If unpaid, the facility can sell the vehicle to recover costs.

Each type of lien has different implications for the car’s title and ownership status, but all must be cleared before the vehicle can be sold or transferred to a new owner.

How Does a Lien Affect Buying and Selling a Car?

A lien can significantly impact the process of buying or selling a car. If you’re selling a car with a lien, you cannot transfer ownership until the lien is paid off and removed from the title. This is because the lienholder (usually the lender) has legal rights to the car until the loan is settled. As a result, the buyer could be at risk of not receiving a clear title, meaning they may not fully own the car until the lien is cleared.

For buyers, purchasing a car with an active lien is risky. If the seller doesn’t pay off the lien, the lienholder can seize the vehicle at any time, leaving the buyer without their purchase and potentially out of money. If you’re buying a used car, it’s important to ensure the lien is paid off, and you’ll receive a clean, lien-free title after the transaction.

How to Check if a Car Has a Lien

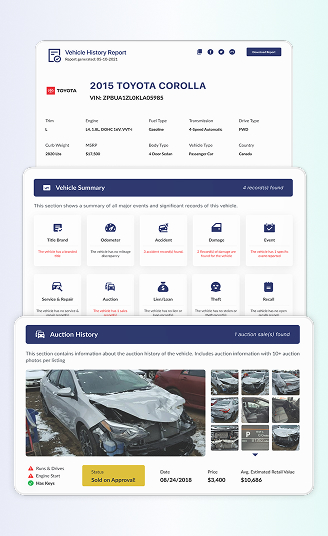

Before buying a car, it’s essential to verify whether there’s a lien on the vehicle. One of the easiest and most reliable ways to check is by running a VIN check. A Vehicle Identification Number (VIN) is unique to every car and is a key detail in accessing the vehicle’s history. When you perform a VIN check with Vehicles Report, you can quickly determine if there’s a lien on the car and other important information like previous owners, accidents, and more.

A VIN check gives you peace of mind, flagging any existing liens and helping you avoid potential legal issues. At Vehicles Report, we provide comprehensive reports that include lien information and offer details like window stickers and license plate information, giving you a complete picture of the car’s history.

Risks of Buying a Car with a Lien

Purchasing a car with an active lien presents several risks. Financially, the biggest concern is that the lender can repossess the car if the lien is not paid off. This can happen even after you’ve purchased the car, leaving you without a vehicle and possibly your money. Additionally, if the lien is not cleared before the sale, you may be unable to register or title the car under your name until the lien is removed.

The legal risks are also significant. If you buy a car with an existing lien and the seller doesn’t pay off the debt, the lender may take legal action against you. In some cases, the original owner could even be sued, further complicating the situation. It’s always safer to ensure the lien is removed before completing the purchase.

How to Remove a Lien from a Car Title

Once the loan or debt tied to the lien is paid off, the lienholder will typically release the lien and update the vehicle’s title. This process can take a few weeks, but you should always confirm with the lender that the lien has been officially released. Requesting a copy of the lien release document is a good idea to ensure the title is clear.

In some cases, if the lienholder is no longer in business or unreachable, you may need to take additional steps to have the lien removed. This may involve submitting paperwork to your state’s Department of Motor Vehicles (DMV) or contacting a legal professional for assistance.

Why Use Vehicles Report for Lien Checks?

Using Vehicles Report to check for liens on a vehicle is one of the best ways to ensure a safe, secure car-buying experience. Our comprehensive reports provide detailed information about a vehicle’s history, including whether a lien is attached. We offer easy access to reports that include VIN decoding, window sticker data, and even license plate checks so you can be confident in your purchase.

When you use Vehicles Report, you’re not just buying a car but making an informed decision. Our accurate and reliable reports help buyers avoid the risks of purchasing a car with a hidden lien, ensuring you can complete your transaction without surprises.

Understanding what a lien on a car is and how it affects the buying and selling process is crucial for any vehicle transaction. Whether you’re a buyer or seller, knowing the lien status of a car is essential to ensuring a smooth transfer of ownership.

Using a VIN check through Vehicles Report, you can quickly verify if a lien is present, giving you peace of mind and protecting your financial investment. Always take the time to verify lien information before completing a purchase, and remember, a little research now can save you a lot of trouble later.

Check out Vehicles Report today for more information on vehicle history reports, including lien data.

Meta Description: Learn what a lien on a car is, how it affects buying and selling, and how to check for liens using a VIN check. Ensure a secure transaction with Vehicles Report’s comprehensive vehicle history reports.