Buying a new car is a huge investment and can be very exciting, but since life can often be unpredictable, the action can be regretted if the unexpected happens.

For instance, you might have owned your vehicle for 6 months and all of a sudden, circumstances change, whether personal or financial or you realize the vehicle no longer suits your lifestyle and budget.

Assuming this is the case, can you trade in the car after 6 months that you have purchased it, and is this recommended?

Since there is no rule that specifies a given period after which you can or cannot trade in your vehicle, there are most certainly some practical considerations that need to be outlined. The first and indeed, the biggest consideration is depreciation.

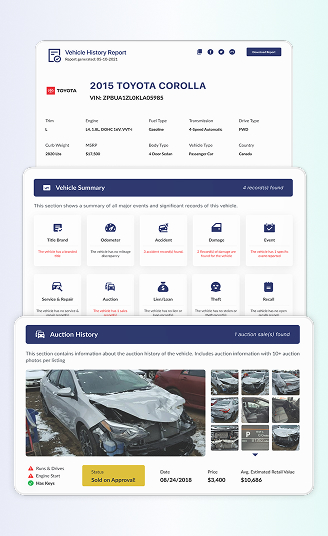

If you’re trading in your car for another used car, use our VIN check tool to know about the history – a car’s history affects its worth and market value.

Consider These Before You Trade In Your Car

1. Depreciation

As soon as a vehicle exits the saleroom, it becomes pre-owned and is thus subject to depreciation, which in some instances is usually huge, especially when it comes to cars that are scarce in the market.

So after just six months of payments, it’s possible for you to owe more on the vehicle than it is worth when trading it. If the only option for you is to trade in your car, please do, but ensure you load the deficit of the vehicle you are trading into the deal of the new vehicle you are buying.

Also, you can pay the deficit if you really need to leave behind the contract as soon as possible.

2. Exceptions

In instances where you have purchased a vehicle that is low or high in demand, you may end up trading it for the same amount or possibly more money than the buying price.

Besides, purchasing a pre-owned vehicle far below market value can afford you the opportunity to break even or still make a little profit from the deal.

3. All Deals are Different

All cars differ in terms of the depreciation and the type of financial deal which also differ in terms of deposits, the duration of the contract, the interest rate, and other additions such as balloon payments.

All these factors might make it difficult for you to know the exact best time at which to trade your vehicle. It’s recommended that you’re aware of when exactly you will pay off the interest owed on the car.

From here, you can start seeing your money paying the actual vehicle itself off, thus allowing you to move towards having equity in the vehicle. This could signal a better time to sell.

When is the Best Time to Trade in a Car?

Usually, most people think they should trade in or sell their car every 2 – 3 years. Even if owning a new car seems exciting, is trading in your current car really worth it?

There are many ways to determine if it’s worth changing your car at a particular time.

First of all, assess your car’s trade-in value, or the dollar amount you will receive from selling your car to a dealer when purchasing a new one. It may be worth buying if it’s high enough to give you a low monthly payment.

The current maintenance cost is another factor to consider. If you think your current car needs some repairs that might cost you a fortune, you may want to take a better route by looking into replacing the car with one without costly repairs.

Make sure you have a budget plan to know if these repairs will fit perfectly into your expenses on a monthly basis.

Since every car differs from the other, it’s important to factor in the events surrounding the current situation about trading in your car.

Use the calculations below to help you decide if trading in your car is the best decision.

How to Calculate the Best Time to Trade in Your Car

If you purchased your car for $40,000, it’s expected that, in the next 3 years, the value will be reduced to about $23,000. Taking the difference between the original price and the current price means you will be left with a depreciation amount of $17,000.

Now, divide the depreciation amount ($17,000) by the number of months you have owned the car, you will find that you paid about $472 per month in depreciation to own the vehicle. So the value of your vehicle decreases by over 10% of the original value annually.

It also makes more financial sense that you keep your car for a long time before trading it for another car.

Bear in mind that the money you lose due to depreciation is not a complete loss. Even though the money is out of your pocket, you will still have a well-running car to use – this I think is a value that is harder to quantify.

Usually, cars lose value faster in the first 2 years of purchase but if you can own it longer, the value will drop much more slowly.

To get a good deal in the trade-in process for another used car, use our Window Sticker tool to know the Manufacturer’s suggested retail price (MSRP) of the car and compare this with the vehicle history report in terms of number of years owned, service history, loan and lien etc.

How to Trade in your Car

Of course, you will want to find a seller who is ready to give you an amount as close to the worth of your car as possible. So, trading in your car effectively is a matter of doing your research and shopping around.

To begin, do some research on your car’s value and verify with our car market value estimator by contacting us. Other resources like Kelley Blue Book can also be used to determine the estimated average value of your car’s make, model and year.

The next thing is to look around for the best trade-in value by visiting a variety of dealerships, including used car lots and official dealers to find the best offer. You should also prepare to go along with the following documents:

- Your driver’s license

- Registration

- Keys

- Car title

- Any other documents verifying the car ownership.

Can You Trade in Your Car Before You’ve Paid it Off?

Are you wondering if it’s possible to trade in your car even when you haven’t completely paid it off?

Though you can, there are other steps to take before making the trade if you still owe money on your auto loan.

When you take a car loan, the car will be used as collateral until all the money has been paid. Usually, it’s for your own good if you pay off the loan before you trade in your car.

One sure-fire way to trade in your car before it’s paid off is to make sure you’re not behind on your car payments. Most dealerships will still allow you to transfer the remaining amount of the loan to the new car’s loan.

So if you finance your new car, your car payments are likely to be higher than you waiting to trade in your car until the loan has been paid off.

Conclusion

You may still ask: “can I trade in a car after 6 months?” Yes, you can, but you will surely be losing thousands of dollars more than you should because the car will drastically lose value within this period.

In addition to the approximately $3000 – $5000 difference between what you paid and what you’ll get in trade, you’re going to pay a lot of money to cover for taxes, DMV charges, and other documentation fees the seller will charge you.

But if you have to get rid of your car due to some financial issues, it’s best to sell. Of course, if you trade in the car, you would still make about 15 – 25% more than just selling it.